Synovus Financial Corp

July 22, 2011 – 6:32 pm

Business Profile

Business Profile

Synovus Financial Corp is a bank holding firm company and has diversified financial presence. The Company had assets of over $31 billion and total deposits of over $24 billion as of December 31, 2006.

Synovus Financial Corp engages in providing integrated financial products and services such as traditional banking, insurance, financial management, leasing and mortgage services. The Company operates through its various banking and non bank subsidiaries. The Company also offers electronic payment processing through Total System Services, Inc (TSYS), which is 81% owned by Synovus.

The Company’s headquarter is located in Columbus, Georgia and its common stock is listed and traded on the New York Stock Exchange under the ticker “SNV.” The Company employed approximately 13,178 full time employees as of December 31, 2006, of which 6,644 were employees of Total System Services, Inc.

Over the years Synovus Financial Corp has grown internally as well as through several acquisitions.

• In March 2006, the Company completed the acquisition of Riverside Bancshares, Inc. for a price of $171.1 million in stock and cash. Riverside Bancshares was the parent firm of Riverside Bank headquartered in Georgia. Following the acquisition Riverside Bank was merged into Bank of North Georgia, a subsidiary of Synovus.

• In April 2006, the Company completed the acquisition of Banking Corporation of Florida for a price of $84.8 million in stock and cash. Banking Corporation of Florida was the parent firm of First Florida Bank headquartered in Florida.

• In July 2006, Total System Services acquired Card Tech, Ltd., a London-based privately owned payments firm for a cash consideration of $59.3 million. The acquired business was re-branded as TSYS Card Tech.

• In November 2005, TSYS acquired an initial 34.0% ownership interest in China Union Pay Data Co., Ltd. for $37.0 million. Subsequently, in August 2006, the Company increased its equity stake to 44.6% in a transaction valued at approximately $15.6 million.

• In March 2005, TSYS acquired 50% ownership stake in Vital Processing Services, L.L.C. from Visa U.S.A. for a total consideration of $95.8 million. The Company changed the name of the acquired entity to TSYS Acquiring Solutions, L.L.C.

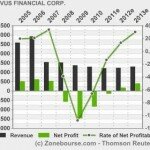

The Company’s net interest income increased 17.0% to $1,133.9 million in 2006 from $968.8 million in 2005.

The Company’s non interest and other income also increased 11.2% to $2,133.6 million in 2006 compared with $1,918.4 million in 2005. Synovus Financial Corp’s non interest expense increased by a lower 11.7% to $2,170.7 million in 2006 compared with $1,943.4 million in 2005. The Company’s efficiency ratio (non interest expense to total income ratio) declined to 51.18% in 2006 from 49.79% in 2005. Synovus Financial Corp’s net income increased 19.5% to $616.9 million in 2006 from $516.4 million in 2005. The Company’s total assets increased 15.3% to $31.9 billion as of December 31, 2006 compared with $27.6 billion as of December 31, 2005. During the same period, Synovus Financial Corp’s net loans increased 15.3% to $24.3 billion as of December 31, 2006 compared with $21.1 billion as of December 31, 2005. The Company’s total deposit grew 16.9% to $24.3 billion as of December 31, 2006 compared with $20.8 billion as of December 31, 2005. The Company’s total equity increased 25.7% to $3.7 billion as of December 31, 2006 from $2.9 billion as of December 31, 2005.

The Company has organized itself into two operating business segments: Transaction Processing Services and Financial Services.

The Financial Services: business segment primarily engages in traditional banking services and products as well as leasing, mortgage, financial management, and insurance services. Traditional banking services include commercial banking services such as commercial, agricultural, real estate and financial loans, and retail banking services such as customary demand and savings deposits; installment, consumer and mortgage loans; leasing services; safe deposit services; automated fund transfers; automated banking services; and bank credit card services.

The segment operates through 40 fully owned affiliate banking institutions and other office of Synovus Financial Corp in five southeastern states viz. Georgia, South Carolina, Alabama, Tennessee, and Florida. As at December 31, 2006, total assets of the segment’s banking affiliate ranged in between $69.2 million and $5.79 billion.

Financial Services’ major fully owned non bank subsidiaries include:

• Synovus Securities, Georgia , which offers investment banking, portfolio management for fixed-income securities, broker/dealer executing security transactions, and financial and investment advisory service

• Synovus Trust Company, N.A., Georgia, which offers trust services

• Synovus Mortgage Corp., Alabama, which provides mortgage services

• Synovus Insurance Services, Georgia, which provides insurance agency products and services

• Creative Financial Group, Georgia, which offers financial planning products and services

• GLOBALT, Inc., Georgia, which offers asset management services.

The Transaction Processing Services: business segment primarily provides electronic payment processing solutions, and debit and stored value card processing services. Electronic payment processing services are provided through Total System Services, Inc., one of the world’s leading outsourced payment services provider. Total System Services contributed approximately 55% of the Company’s total revenues and 33% of the Company’s net income during 2006. Total System Services serves both financial and non-financial companies across the nation as well as internationally. Through its fully owned subsidiary, TSYS Acquiring Services, L.L.C., the division also offers merchant acquiring services to financial companies in US. In Japan, the merchant acquiring services are offered through the division’s majority owned, GP Network Corporation.